- #Quickbooks workforce payroll support how to

- #Quickbooks workforce payroll support software

- #Quickbooks workforce payroll support password

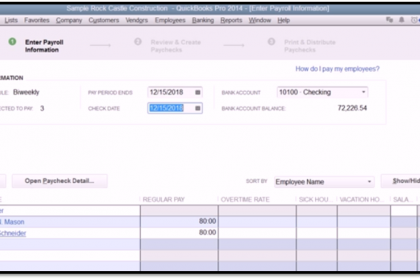

It will also require you to enter the physical address where the majority of your employees work. You can get YTD information from the last payroll you processed for each employee and also request detailed pay reports from your previous payroll provider.Īside from payments to employees in the current calendar year, the system will ask you to indicate the date that you plan to run your first payroll in QuickBooks. Providing information about prior paychecks issued to employees before the beginning of your QuickBooks Payroll subscription is an essential step to ensure that your W-2 forms are accurate come year-end. Note that the system will require you to input year-to-date (YTD) payroll details and tax payments made for each employee later in the setup. Newly established businesses that have yet to run their first payroll can select “No” and then click “Next.” If you want to see it in action, check out our QuickBooks Payroll setup video. The same goes for QuickBooks-its setup wizard guides you through the whole process. Most online payroll services offer an intuitive interface that makes payroll setup easy. If you are converting to QuickBooks Payroll in the middle of a calendar year, you should enter the total sick and vacation hours an employee had from your previous system. PTO policy and balance: If you offer vacation and sick pay, you need to know the total number of PTO hours you’re allocating to each employee for the year.Direct deposit authorization form: If you pay employees via direct deposit instead of paper checks, you must have them complete a direct deposit authorization form.Payroll history: If you already paid employees within the current calendar year, you should have your prior payroll data on hand to ensure accurate tax calculations.Form W-4: Upon hiring new employees, you need to have them complete and sign a W-4 form so you can enter their withholding information and other pertinent details that you need to correctly calculate payroll tax deductions.Paycheck deductions: You should have a list of your employees’ contributions to health insurance, retirement plans, and garnishments.Pay rate and schedule: You can set up multiple pay schedules in QuickBooks, if needed.Employee information and hire date: You need basic information about your staff members, such as their legal names, birth dates, and hire dates.

#Quickbooks workforce payroll support how to

How to Manage Credit Card Sales With a Third-party Credit Card Processor How to Manage Credit Card Sales With QuickBooks Payments How to Reconcile Business Credit Card Accounts How to Manage Downloaded Business Credit Card Transactions How to Enter Business Credit Card Transactions Manually Part 5: Managing Business Credit Card Transactions How to Handle Bounced Checks From Customers How to Transfer Funds Between Bank Accounts How to Manage Downloaded Banking Transactions How to Enter Banking Transactions Manually How to Set Up the Products and Services List How to Set Up Invoices, Sales Receipts & Estimates With these links, you can easily find what you are looking for and get the most out of your quickbooks employee login search.How to Customize Invoices, Sales Receipts & Estimates Make sure to check the official website and log in with your information. We have updated the list of quickbooks employee login websites for your convenience. QuickBooks Desktop Payroll Paystubs Online – InStaff.

#Quickbooks workforce payroll support software

#Quickbooks workforce payroll support password

Login and password | QuickBooks Online Payroll AU.Employees and Payroll – QuickBooks – Intuit.Configure and grant access to the Employee Portal in ….Sign in to your QuickBooks Online Payroll account.Sign in to Access Your QuickBooks … – QuickBooks Online Login.

0 kommentar(er)

0 kommentar(er)